How Modeling the Value of Your Time with a Single Number Can Simplify Decisions

My friend carried a box of her used cans and bottles into the Safeway and waited at the customer service counter. Minutes later, a customer rep tallied up the 5- and 10-cent containers, double checked the math, and rewarded my friend with a dollar and change for her 10 minutes of patience. My friend’s frugality and thriftiness – no doubt passed down from her Asian immigrant parents who had painstakingly saved their way into the US middle class – made it difficult for her to simply discard her 5- and 10-cent container deposits, money that she viewed as rightfully hers. And so she dutifully made the trip every few weeks.

The part that didn’t make sense? My friend worked at Google as an engineer and earned over $60 an hour. But each of these excursions valued her time barely higher than minimum wage. It took some convincing before she agreed that she ought to break the habit.

While it might be obvious to many engineers and young professionals that exchanging cans and bottles for nickels and dimes isn’t worth our time, my friend is hardly the only person to make that type of mistake. Many smart people undervalue their own time and subconsciously or accidentally trade their time for a low wage.

For someone who makes, say, $85K a year – the median salary of a software engineer in the US – 1 certain common behaviors are economically irrational, assuming that we don’t derive any non-financial utility from them:

- Comparison shopping on multiple websites for 30 minutes looking for the lowest possible price, only to save $5 on a memory card that we want for our camera.

- Clipping physical or digital coupons for 10 minutes to save $2 on a purchase.

- Waiting 30 minutes for a public bus or shuttle to arrive rather than paying the $10 to hail an Uber, Lyft, or cab to our destination that’s only 10 minutes away by car.

- Spending 15 minutes looking for a free or metered parking spot in a busy district rather than dishing out $6 for guaranteed parking at a lot.

- Attending the museum on a “free” day, when the lines for all exhibits are at their peak capacity, rather than shelling out the $20 to go on an off-day.

- Lining up for 20 minutes for a free taco at Taco Bell because we heard about it on a radio ad.

- Not buying clothing that we like because another store might sell something comparable at a cheaper price, without factoring in the 30 minutes it takes each time to try on clothing.

These activities price our time too cheaply, assuming they’re not activities we actually enjoy doing. If clipping coupons and waiting in lines are your idea of fun, then by all means don’t let me distract you with this article. But if you want to spend your time more effectively, if these activities take time away from family, friends, hobbies, volunteer work, or whatever else you enjoy doing, then read on. So when does it make sense to trade our time for money? When should we pay money to avoid undesirable, time-consuming experiences? A good framework on how to value our time can help us answer these questions and make better decisions. Surprisingly, modeling our time’s value with just a single number can be extremely valuable.

Why Model the Value of Time with a Single Number

If we can compute a single number to represent the monetary value of our time, it can simplify many of the decisions we make. Our true utility function according to an economist might be more complicated, but a single number can be a useful approximation for certain day-to-day decisions. Simply compare the value of our time against how much a given activity would save or earn us per hour. If we stand to gain more, do the activity; if not, pay money to protect our time.

That’s not to say we should always equate time with money. It’s dangerous to assign a price tag to time spent with family and friends, to our happiness, to our health, or to many of the experiences and adventures we have in life. But for a certain class of decisions – the boring, day-to-day ones where we’re indifferent to the actual activity – it can be very helpful to have a simple framework to quickly assess whether we should exchange time for money.

For example, we can use it to reduce indecisiveness and limit how much time we spend agonizing between two choices. If a decision can save us at most $10, and we value our time at $1 per minute, we should spend no more than 10 minutes making the decision. After that point, we’re wasting more time than we’d be saving in costs and might as well just flip a coin.

We can use our time value to answer more complex questions as well. I remember many years ago paying $15 to take a SuperShuttle van from San Francisco International Airport (SFO) to Palo Alto. The ride normally would have taken 20 minutes by car, but because the van had to wait for and drop off 5 other passengers before me, the entire ordeal consumed over 90 minutes. I vowed after that experience to never take SuperShuttle again.

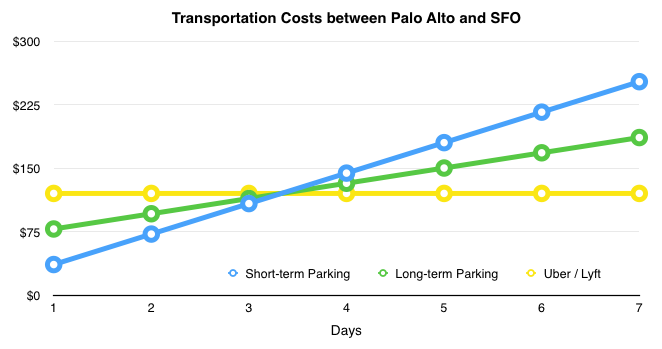

But what should I do instead? Should I pay for an Uber or Lyft? Should I spend time (and for how long) trying to find a stranger heading in the same direction who might want to split a cab? 2 Should I pay $36 per day for nearby short-term parking? Or pay $18 per day for long-term parking with the caveat that it might take 30 minutes to wait for the parking shuttle that takes people to and from the long-term parking lot? Does public transportation make sense? How does the equation change when there are two people?

Assuming that we treat this as a purely financial decision and don’t have strong preferences for a particular mode of transportation, the beauty of using a simple number to model our time’s value is that we can compute the cost of each mode of transportation as a function of the number of people and the length of the trip. For example, assume for simplicity that we value our time at $1 a minute, that long-term parking adds 1 additional hour of shuttle time round-trip, and that an Uber or Lyft costs a $60 flat rate. We could then model the costs of various transportation modes as follows:

Based on these parameters, the optimal decision would be to use short-term parking for trips up to 3 days, Uber or Lyft for trips longer than 3 days, and to always avoid long-term parking. Your own decision rule will vary based on your parameters. But the model is flexible enough that we can include other transportation options if we know the average wait times; we can even scale up the cost of wait time if we have more people. We don’t have to do a complex analysis like this for every decision we make (the analysis costs time too), but this analysis illustrates what’s possible when we have a simple model of our time’s value.

Similarly, we can use our model to answer questions like: How much more should we be willing to pay to avoid a 2-hour layover on a flight? Should we pay an accountant to do our taxes? Should we outsource a task or do it ourselves? Should we pay for a book, a course, or a tool that helps us get more done?

Once we internalize this model, an immediate corollary is that the time we spend on a purely financial decision should be proportional to how much money it can save or generate for us. If negotiating a job salary can get us $3,000 more income post-tax, we should in theory be willing to spend 1,000x more time on that decision than a small decision that can save us $3. Most of us don’t do that, and we’d be much better off if we focused more time on the bigger decisions.

How to Compute the Value of Your Time

So how do we arrive at a number for time’s value? One candidate is our post-tax hourly earnings rate, defined as our post-tax income (salary and benefits) divided by the number of hours worked. It’s an understandable model of time value that we can easily compute. If someone earns $100K a year with 15 days of vacation and 10 holidays, working 40 hours/week, that’s $53/hour, or roughly $32/hour post-tax (assuming a 40% tax rate). If he instead works 60 hours per week, the post-tax number drops to $21/hour post-tax. Determining whether an activity is financially beneficial then reduces to figuring out whether it saves or earns more money than the post-tax hourly earnings rate. This number, however, doesn’t take into account how much free time someone actually has. Intuitively, someone at a startup or an investment bank who’s working 80 hours per week values their time more highly because their free time is rarer.

An alternative model that addresses this shortcoming is the break-even spending rate, defined as total post-tax earnings divided by the amount of free time. Another way to think about this is the amount of money one needs to spend per hour during one’s free time to end up with zero savings. Assuming we sleep 8 hours per day and spend 1 hour per day on basic needs, there are 105 hours left per week to divvy up between work and free time. The break-even spending rate for the $100K income individual above who works 40 hours a week (and therefore has 65 hours a week of free time) would be roughly $20 per hour. It goes up to $28.50 if he works 60 hours per week and $51 if he works 80 hours per week. The break-even spending rate therefore values time more highly for someone with less free time.

Neither model is perfect, and you can adjust the resultant number up or down based on the specifics of your personal situation. You might have willingly taken a more interesting but lower-paying job, or you might be compensated partly in startup equity; as a result, you might value your time more because the option for higher income remains available. Savings goals (most people don’t want to have zero savings), purchasing goals (like a house), debt obligations (including student loans), or non-financial enjoyment that you derive from an activity might lead to downward adjustments and bias you toward paying with your time. Conversely, wanting to spend more free time with friends and family, strongly disliking certain types of work, or already having a large bank balance might increase your time value.

The exercise of quantifying various adjustments is a hard exercise, but even having a fuzzy approximation is better than nothing. You might even make a rounding adjustment to make mental math easier. Ultimately, you can factor in whatever inputs matter to you. The output of all this upfront work is a single number that models the value of your time. The model helps you understand when it’s rational or irrational to do something from an economics point of view and reduce wasted time.

It won’t always make sense to reduce your decision to a simple numerical comparison. Many experiences are immeasurable and hard to quantify. But there are also increasingly more technology and services that let us buy back more of our time. Odesk lets us outsource tasks to remote workers. Uber and Lyft let us reduce time spent waiting for transportation. Amazon Prime and Google Shopping Express let us wait in fewer lines in physical stores. Homejoy makes it easier to get hired help to clean our homes. TaskRabbit can take care of many other assorted needs.

Understanding how much our time is worth lets us spend more of our time – our most limited asset – in the right places.

“Software Engineering Salaries”, Glassdoor. ↩

Before Uber and Lyft became popular, splitting a cab would have been the optimal financial choice for me if it took fewer than 10 minutes to find a stranger willing to split cab fare to Palo Alto. Unfortunately, my experiments ultimately rejected this approach because it’s surprisingly hard to find someone else heading toward Palo Alto. ↩

“A comprehensive tour of our industry's collective wisdom written with clarity.”

— Jack Heart, Engineering Manager at Asana

“Edmond managed to distill his decade of engineering experience into crystal-clear best practices.”

— Daniel Peng, Senior Staff Engineer at Google

“A comprehensive tour of our industry's collective wisdom written with clarity.”

— Jack Heart, Engineering Manager at Asana

“Edmond managed to distill his decade of engineering experience into crystal-clear best practices.”

— Daniel Peng, Senior Staff Engineer at Google

Leave a Comment